Greetings, aspiring homeowners! Embarking on the thrilling journey of purchasing your first home in Oklahoma is a discovery-filled experience. Soon enough, you’ll encounter a critical document known as the “Oklahoma Real Estate Purchase Agreement.” Don’t let its official terminology intimidate you; this agreement is essentially the contract between you and the seller, acting as a crucial component of the home-buying journey.

Here’s where we come in! We at OKCHomeSellers are here to illuminate the path for you. With our years of experience and thousands of purchase agreements under our belt, we’re well-positioned to guide you through every twist and turn of this process. This enlightening blog post walks you through the Oklahoma Real Estate Purchase Agreement, breaking it down section by section.

It’s important to note that what we’re discussing here is essentially the basic Oklahoma Real Estate Purchase Agreement form. In most transactions, it’s not uncommon for this form to have one or more attachments added to it, effectively making them part of the contract. These attachments, also known as addenda, might include details about the property, contingencies, and other specific aspects of the deal. For the purpose of this post, however, we will focus solely on discussing the basic contract and its individual sections. This foundational understanding will serve you well as you delve deeper into home-buying.

Our goal? To demystify this vital document and make your home-buying process as smooth as possible. We believe in empowering you with the knowledge and understanding needed to navigate this agreement successfully. With our guidance, you’ll be able to make informed decisions as you embark on this exciting new chapter of homeownership. Trust in our expertise, and let’s begin this journey together.

Disclaimer

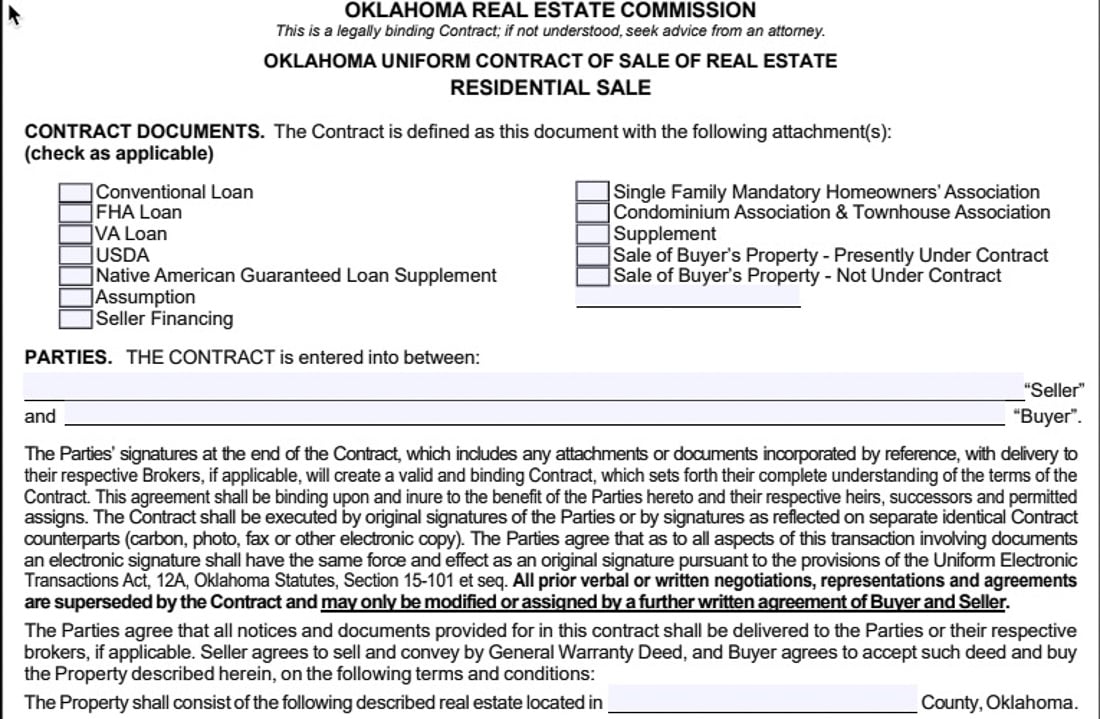

As licensed real estate professionals, it’s important that we inform you that our expertise lies solely in matters related to buying or selling properties. We are not lawyers, so we cannot offer legal advice. At the top of the form states: This is a legally binding Contract; if not understood, seek advice from an attorney. If you need guidance, we are happy to help you find the right professionals who can.

Contract Documents: This section lists all the documents that are part of the contract. The buyer can mark which documents apply to their sale and become a part of the contract. Some examples include different types of loans (like FHA, VA, or Conventional Loan) and other specific conditions (if the buyer’s current home needs to be sold first).

Parties: This section introduces who is involved in the contract. It specifies the “Seller” and the “Buyer”. Both the buyer and seller will sign the contract, making it official. The contract can be signed in different ways, like by hand or electronically, and both ways are okay.

Notices and Documents: This part says that any official notices or documents related to the contract should be given to the buyer, seller, or their real estate agents (brokers). This makes sure everyone involved knows what’s going on.

In simpler terms, this first page sets the stage for the contract. It lists out what documents are part of the deal, who’s involved, and how they’ll communicate. It also reminds everyone that the contract is a serious, legal document.

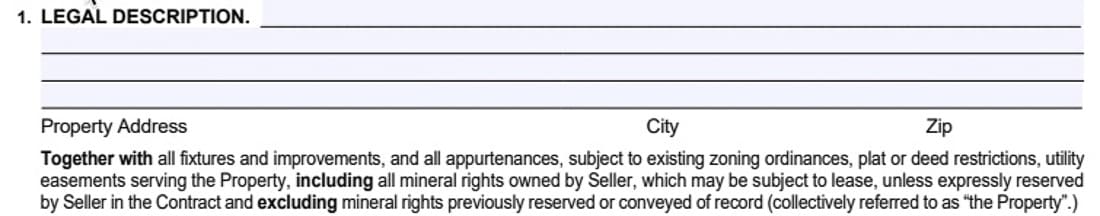

This is about the house that’s being sold. Its legal description is included here. It’s saying that the buyer is agreeing to buy the house and the land it’s on, along with anything else that’s attached to the land, like a garage or a fence. It also says that the seller promises they have the right to sell the house. Mineral rights are included in the sale if the seller owns them or specifically excludes them in the contract.

This part is about money. It says that the buyer is promising to pay a certain amount for the house. This amount is called the “purchase price”. The buyer gives some money upfront (called “earnest money”) to show they’re serious about buying the house. If the buyer doesn’t follow through with buying the house, they might not get this money back.

This section discusses when the sale will be finalized, called the “closing”. It says that the closing should happen by a certain date. At the closing, the buyer will pay the rest of the purchase price, and the seller will give the buyer the deed to the house. This is when the buyer officially becomes the owner of the house. The paragraph also mentions that the buyer and seller each have their own costs to pay during this process. This also declares when possession of the property takes place.

This part is about the stuff that comes with the house. It’s saying that certain things, like the oven, the heating system, the mailbox, and even the garage door opener, are part of the deal and will stay with the house when it’s sold. It also says that if there’s anything that the seller wants to take with them, they have to list it here. So, if the seller wants to take their fancy fridge with them, they have to say so in this section.

This section is about when certain things need to happen. It’s saying that the clock starts ticking on certain deadlines from a specific date. This date is usually 3 days after the buyer and seller both sign the contract but can be changed if desired. So, if the contract says the buyer has 10 days to inspect the house, those 10 days start at the Time Reference Date. If the contract doesn’t say the specific date for the Time Reference Date, it’s three days after the contract is signed.

This part is about the seller telling the buyer about any problems with the house. The seller has to give the buyer a document that lists any issues with the house that they know about. This could be things like a leaky roof or a broken furnace. The seller also has to tell the buyer if there are any environmental hazards, like lead paint or asbestos. The seller isn’t responsible for anything they didn’t know about. Oklahoma law requires sellers to disclose any know material defect.

This section is about the buyer checking the house for any problems. The buyer can hire professionals to inspect the house and find any issues. This could be things like a broken air conditioner or a cracked foundation. The buyer has to pay for these inspections. Here’s what the different parts mean:

7A: This part says that the buyer has a certain amount of time to inspect the house. If the buyer doesn’t inspect the house within this time, they can’t ask the seller to fix anything they find later.

7B: This part says that the buyer can ask the seller to fix certain things in the house before the sale is final. The buyer has to tell the seller what they want to be fixed in writing. If the seller agrees to fix these things, they have to do it before the sale is final.

7C: This part is about what happens if the buyer finds something they don’t like during the inspection. The buyer can ask the seller to fix it, or they can decide not to buy the house.

7D: This part says that if the buyer doesn’t cancel the contract or ask the seller to fix anything by a certain date, they have to buy the house as is.

7E: This part is about the final walk-through. The buyer can look at the house one more time before the sale is final to make sure everything is as it should be.

This part is about what happens if something bad happens to the house before the sale is final. It’s saying that until the buyer officially owns the house, the seller is responsible if something bad happens to it, like if it gets damaged in a storm. After the buyer officially owns the house, then they are responsible.

This part is about accepting the house. It’s saying that once the buyer officially owns the house, they accept it as it is. This means that the seller isn’t promising that everything in the house will keep working after the sale is final. The seller isn’t responsible for any problems that come up after the buyer takes ownership.

This part is about the paperwork that proves who owns the house. Here’s what the different parts mean:

This part is about the taxes on the house. It’s saying that the seller has to pay all the taxes on the house up until the day the sale is final. After that, the buyer is responsible for the taxes. If the exact amount of taxes isn’t known by the time the sale is final, the seller will pay an estimated amount, and then either the buyer or seller will pay more or get money back once the exact amount is known.

This section is about a home warranty. A home warranty is a service contract that covers repairing or replacing important home system components and appliances that break down over time. It says that if the buyer wants a home warranty, they must pay for it. The seller isn’t responsible for paying for a home warranty unless they agreed to it in writing.

This is where any ‘fine print’ can be added to the contract. This section is a blank space where the buyer can add any other agreements or details that aren’t covered in the rest of the contract. It’s a place for any special notes or conditions that both parties agree on.

This part is about solving disagreements. If the buyer and seller disagree about the contract they can’t solve by talking to each other, they agree to try mediation. Mediation is when a neutral third person (the mediator) helps the two parties talk and try to come to an agreement.

This section is about where and how any legal disagreements about the contract will be handled. It says that any legal actions will be based on Oklahoma laws and handled in Oklahoma courts. This means if there’s a problem and someone wants to take it to court, they have to do it in Oklahoma using Oklahoma’s rules.

Time is of the Essence: This is a legal phrase that means every deadline in the contract is super important. Both the buyer and the seller have to do everything they promised to do exactly when they said they would. They could get in trouble if they don’t, or the other party might have the right to end the contract.

16A – Breach: This part is about what happens if one of the parties (either the buyer or the seller) doesn’t do what they promised to do in the contract. If the buyer doesn’t follow through with buying the house (like if they don’t pay the money they promised), the seller can keep the earnest money (a deposit the buyer gives when they make the offer) as damages. But the seller can’t keep more than 5% of the purchase price. The seller can also choose to take other legal actions.

16B – Failure to Close: This part is about what happens if the sale doesn’t go through because the buyer doesn’t get the money they need (like if their loan doesn’t get approved). If the seller has done everything they were supposed to do, and the buyer still can’t buy the house, the seller can cancel the contract. The seller can then keep the earnest money but not more than 5% of the purchase price.

17A – Incurred Expenses: This section is about any costs arising from the contract. It says that if the buyer or seller has any expenses, they have to pay for them themselves. They can’t use the earnest money (the deposit the buyer gives when they make the offer) to pay for these expenses.

17B – Release of Earnest Money: This part is about what happens to the earnest money if there’s a disagreement. The earnest money is held by a third party (like a bank or a lawyer) until the sale is final. If the buyer and seller can’t agree on something, the third party will keep the earnest money until:

This means that the real estate agents can receive and deliver the paperwork that says both parties agree to the sale. This helps speed up the process and makes sure everything is done correctly.

This section is about the seller’s status related to U.S. taxes. Here’s what it means:

In simpler terms, this section is making sure that the seller follows U.S. tax rules if they’re not a U.S. citizen or resident. It helps the buyer know that the seller is handling their taxes correctly.

This is a date and time shown on the contract, at which time the offer will automatically terminate. An offer may be withdrawn by a buyer prior to acceptance. It also has a signature block for the seller if they wish to reject the offer.

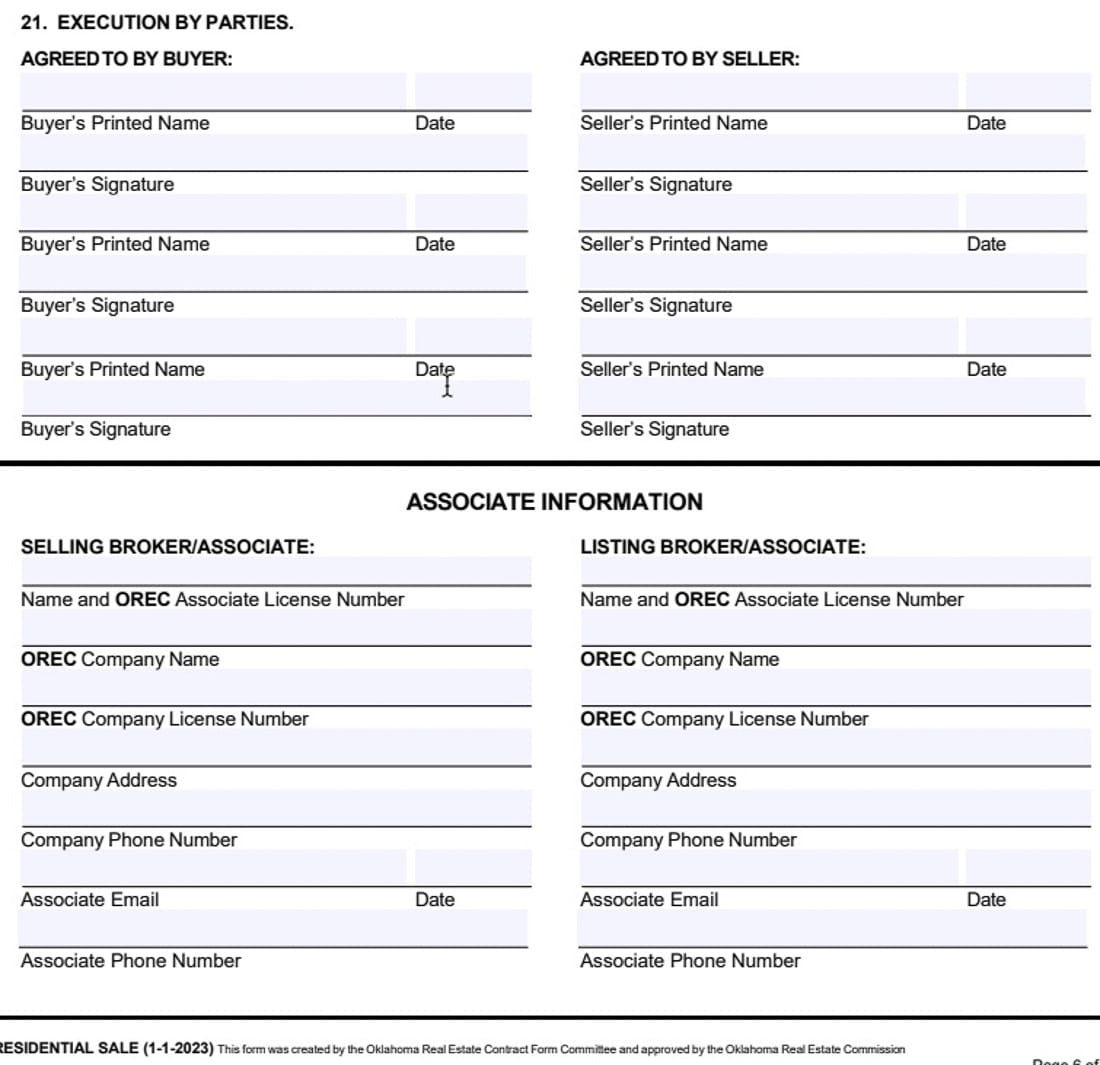

Execution by Parties: This section is about making the contract official. The buyer and seller must write down their names and sign the contract. By signing, they’re saying they agree to everything in the contract. If there’s more than one buyer or seller, each person has to sign.

Associate Information: This part is about the real estate agents (also called associates or brokers) who are helping with the sale. It gives space for the agents to write down their names, license numbers, company names, addresses, phone numbers, and email addresses. This information is important because these agents will be the main people handling the sale and making sure everything goes smoothly.

In simpler terms, this section is about making sure everyone involved in the sale (the buyer, the seller, and their agents) agrees to the contract and has their contact information listed.

Comprehending each clause in your real estate contract is crucial to evade potential risks and guarantee a seamless transaction. We here at OKCHomeSellers have broken down the complexities of standard provisions and provided a simplified interpretation, acting as a reference point. Nonetheless, this explanation is not a substitute for professional legal advice, as each transaction is distinct.

If you find yourself overwhelmed by complex real estate terminology or unsure about the implications of a contract, consulting with a seasoned real estate professional or attorney is essential. Feel free to get in touch with us at OKCHomeSellers for tailored guidance and expert assistance to simplify your real estate journey. We’re committed to ensuring your buying or selling experience is smooth and hassle-free. Being well-informed is the first step towards a successful transaction, and we’re here to empower you with the knowledge you need.

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.